Net cash flow is the amount of money received and used in a business. Before you get your small business on the road, you will need to know how to calculate net cash flow. The cash flows are divided into three categories, operational, financial, and investment.

Step 1- The Calculation Net Cash Flow of Operational Activities

Operational activities are the goods and services a business delivers. The cash flow will help get an estimate regarding the amount of money, which is used while the goods and services are being delivered. In order to calculate the operational activities cash flow, there are three points to keep in mind.

- The cash inflow in this category includes cash received from the sale of goods, services, any form of cash received, receivables, cash dividends, and cash interest.

- Cash outflow is the cash given to the employee, suppliers, petrol pump, taxes, fees, fines, interest etc.

- If you decide to use the indirect method to calculate, the outcome will reflect the total net income, changes, or increase in your liabilities and assets, such as inventory, payables, and receivables.

Step 2- The Calculation Net Cash Flow for Financial Activities

Just like operational activities, financial actives are also recorded. The amount of cash generated are the financials, this amount is generated through sales, stocks, bonds, or other sources. There are two important points to remember,

- Cash outflow in finance is the amount of cash paid towards debt, to reacquire equity, buy back stocks, or to divide the amount of cash within the number of shareholders equally.

- Cash inflow is the cash generated from stocks, contributions, borrowing (loan), and investment income.

Step 3- The Calculation Net Cash Flow from Investing Activities

This is to determine the total amount made by investments. Keep in mind,

- Cash inflows here will be the amount of money collected on principal note, sales of bonds, equity, property, sale of equipment etc.

- Outflow will be the amount paid for purchases of assets, to acquire debt, purchase of property, equity interest, etc.

Step 4- The Final Calculation

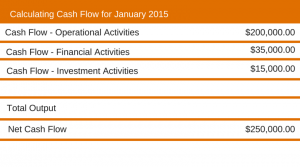

After all three categories are totaled separately, combine the three totals in to one, that amount the ending balance is. This helps you generate an idea of the amount of money that is generated over a certain period. The following is an example:

Remember, you can use either the direct or indirect method to calculate net cash flow, both are considered accurate.

About ActionCOACH

Brad Sugars founded the brand Action International in 1993 when he realized there was a disconnect between business advice and implementation. The answer was Action! Brad Sugars created a business coaching company so that business owners throughout the world can realize their goals in business. Today the company is known as ActionCOACH. To learn more about business, visit Brad Sugars Review blog!